You must submit a completed ERP application for every week you think you may be eligible, as applications will not be held until you are eligible. You can collect for a week of benefit as long as you have worked no more than one day in a work week (Monday – Sunday). If you get laid off in the middle of a work week, you do not need to fill anything out to “get your benefit started”.

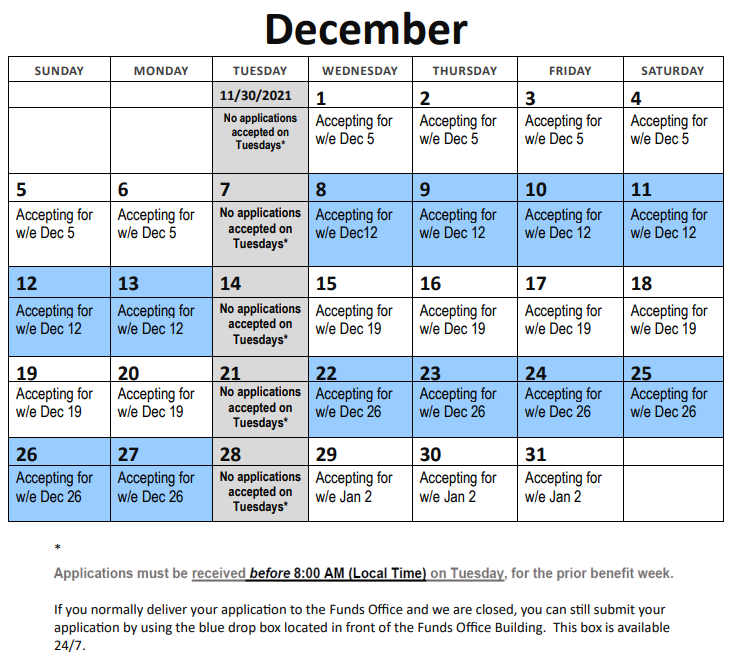

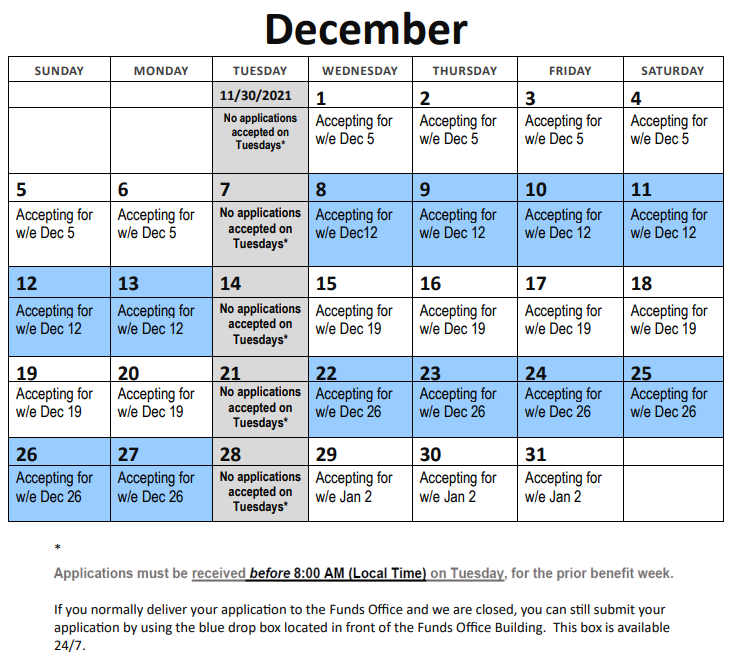

Applications are accepted Wednesday thru 7:59 AM (Local Time) on Tuesday . No application will be accepted after 7:59 AM (Local Time) on Tuesday. You can submit via mail, fax, email, and online with your username and password. We also have a blue drop box outside of the TEWF Building for 24/7 form submittal. See below Calendar schedule for date submission information.

Calls go to Book II – This is a suspended week of benefit with the exception: Only Apprentices, Travelers, Teledata and members with a delayed start are eligible to apply.

Calls go to Book II – This is a suspended week of benefit with the exception: Only Apprentices, Travelers, Teledata and members with a delayed start are eligible to apply.

Calls go UNFILLED – This is a suspended week of benefit with the exception: ONLY Apprentices, Teledata and members with a delayed start are eligible to apply.

Suspended week cannot be used as a waiting week.

Applications must be received by Monday end of business day (5 PM) for previous work week. We will not retroactive payment for late applications.

Benefit payment is by direct deposit only. Deposits will show up in your bank on Friday for previous week of benefit. Example: For week ending Sunday, December 27th deposit for that week of benefit will be on Friday, January 1st.

You can mail, fax, submit on-line, email or walk in ERP Applications to the Fund Office.

If submitting on-line, choose login from the menu and select to Login as a PARTICIPANT. Once logged in and your personal information appears in the General Information Field, select ERP from the menu options. You will then be given the option to select ERP Application to apply online. Once you have filled out the on-line application click submit and you should receive a confirmation number. Please print your confirmation number as this will be your proof of submission if a problem arises. If you do not receive a confirmation number, then your application did not process.

If you do not have a username and password, please contact the Fund Office at 419-666-4450.

The week ending date is always a Sunday Date.

Before logging into the site, you are given other options to apply for ERP. From the menu select BENEFITS then select ERP Benefits. There will be a dark colored box on this page titled DOCUMENTS. There you will find the option to print the ERP application to mail, fax, drop off in the blue box outside the building after hours or submit in person to the Fund office. You will also find the option of a Fillable ERP/SUB FUND APPLICATION. This option will allow you to type in your application and save it to your device so that you may easily email the application to erp@electricalfunds.org.

It is your responsibility to make sure your application is in the office by the required date regardless of computer or any other issues.

Calls go to Book II – This is a suspended week of benefit with the exception: Only Apprentices, Travelers, Teledata and members with a delayed start are eligible to apply.

Calls go to Book II – This is a suspended week of benefit with the exception: Only Apprentices, Travelers, Teledata and members with a delayed start are eligible to apply.